- 165Shares

- Facebook117

- Twitter11

- LinkedIn14

- E-mail7

- Buffer14

- WhatsApp2

The London newsroom of the BBC, one of Europe’s largest and best-funded public service broadcasters.

A study of Europe’s Public Service Media (PSM) has revealed the 2008 global financial crisis forced some public broadcasters to make significant strategic changes to policy, funding and content while others were barely affected. It found that PSM budgets vary enormously across Europe and organisations do not share a common financial or organisational strategy.

The European Journalism Observatory (EJO) compared budgets, market strategies and accountability of PSM in nine European countries in early 2017, to examine whether they were impacted by the financial crisis. The study aimed to provide an overview of public service policies and finances, nearly ten years after the crisis.

Significant variations in PSM budgets and funding methods across Europe were identified. The EJO study, based on analysis by locally-based media researchers and publicly available documents, also found that the way a PSM is funded appears to make little difference to the level of independence it experiences.

The EJO reviewed large (Germany, UK and Italy), medium (Poland and Romania) and small media markets (Czech Republic, Portugal, Switzerland and Latvia).

PSM in some of the countries consists of television, radio and associated digital platforms (such as websites, dedicated YouTube channels and dedicated pages on social media). Other national public broadcast organisations include a press agency, also funded from the state budget. The EJO study is limited only to television and radio broadcasters and their related internet presence.

The term Public Service Media is used in this report as it best reflects that most public media organisations now operate on multiple platforms, however it is noted that most are still dominated by their broadcasting legacy.

PSM budgets vary across Europe

Nearly ten years after the economic crisis, PSM budgets across Europe vary enormously, from over six billion euros down to 20 million euros per year. The European PSM that receives the most funding annually is Germany’s ARD, the least-funded is TVR – Romanian Television – which was rescued from near bankruptcy in 2016.

Discrepancies are even more apparent in a per capita comparison (total budget versus population). In 2016 Romanian, Latvian and Polish PSM had revenues of approximately 10 – 12 euros per capita, while revenue for Germany and United Kingdom was far higher at 82 and 87 euros per capita, respectively. Switzerland appears the best funded, a budget of 181 euros per person. However, Switzerland, with public service media in four languages, incurs higher costs than most.

No common financial strategy

In some countries, PSM radio, television and the additional websites, are governed by a single body, in others they are separate. For example, public radio and public television are managed separately, by different organisations, in the Czech Republic, Poland, and Romania.

Financing formulas differ

European PSMs are funded in different ways. Some through a licence fee, others directly from state budgets or from advertising revenues.

Most PSM organisations in the EJO study are eligible to earn advertising income. Advertising provides over 50% of Polish Television’s income, for example. In Italy, commercial sources – mostly television advertising – make up around 40% of RAI’s income; the balance is funded by licence fee.

The British Broadcasting Corporation (BBC) is the only national PSB not legally permitted to carry advertising or sponsorship. The BBC is primarily funded by an annual licence fee of 163 euros (£147) per household, but around a quarter of BBC revenues come from its commercial arm, BBC Worldwide Ltd, which sells BBC programmes and services internationally.

BBC Worldwide also distributes the BBC’s international 24-hour English-language news service, BBC World News, and from BBC.com, provided by BBC Global News Ltd. (according to the BBC annual report).

In Switzerland public television and public radio have a significant (around 60% for radio and between 30% and 38% for TV) share of the market. This disadvantages the country’s commercial broadcasters which also face heavy competition from commercial and public broadcasters in neighbouring Germany, Italy and France. In order to make up for these disadvantages, a small (4%) share of the revenue raised by national broadcast licence fees is used to subsidise commercial Swiss broadcasting companies.

The European PSM that receives the most funding is Germany’s ARD, a conglomerate of regional broadcasters. Its income is based on a combination of a relatively high licence fee (the broadcasting contribution, Rundfunkbeitrag, is 17.50 euros per household per month – 210 euros per year) and the large number of households required to pay. Low income families and students are exempt from the licence fee. Public funding accounts for 86% of ARD’s total revenues and 85% of ZdF’s, Germany’s second PSM.

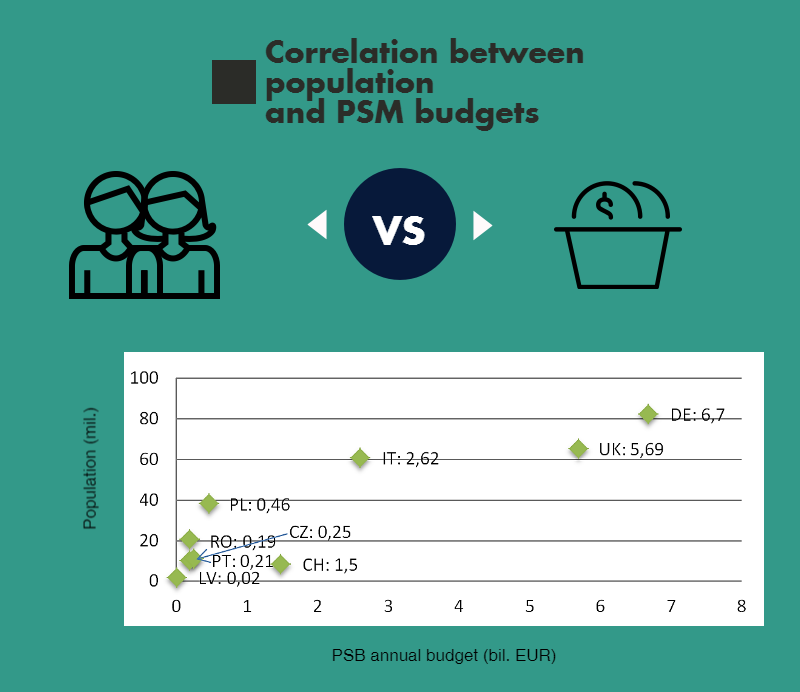

As seen in Fig 1, public service broadcasters’ budgets depend largely on population size and economic power. Sources: population size: Eurostat, 2016; budgets for PSB: ARD, Germany, 2015; BBC, United Kingdom, 2015; RAI, Italy, 2016; SRGSSR, Switzerland, 2016; TVP, PR, Poland, 2016; ČT Czech Republic, 2016; RTP, Portugal, 2015; TVR, SRR, Romania, 2016; LTV, LR, Latvia, 2015.

In countries where radio and television belong to separate companies, the financial data is a sum of their incomes.

The global financial crisis and PSM: how public broadcasters responded

In the short term at least, the 2008-2009 global financial crisis caused advertising revenues to decrease and also led to a drop in the number of people paying the licence fee. The EJO study found that many PSMs in Europe were forced to change strategy in response to the revenue cuts.

1. Czech Republic: 2008 had little impact

The Czech Republic escaped the worst effects of the economic crisis and public broadcasters reported no significant financial difficulties as a result of the downturn. However, the country’s commercial broadcasters lobbied for limitations for advertising sales by Czech Television (CT), leading to a political decision in this regard.

Czech Television’s main financial sources are television licence fees and income from business operations (such as advertising). The Czech media market is a similar size to Portugal’s and the PSMs in the two countries also have similar budgets. However, public service broadcasters in the Czech Republic employ twice as many people as Rádio e Televisão de Portugal.

2. Germany: changes to way licence fee levied

The financial crisis had little immediate impact on German PSMs, but it mobilized the government to make some adjustments to the way public broadcasters are funded. Since 2013, every household in Germany must pay a licence fee of 17.50 euros per month (210 euros per year). Exemptions include low-income families and students.

The new fee replaced the former GEZ (German TV Licensing Office) radio and TV fee which was paid per device (and not per household). This made the fee more acceptable and manageable for all parties.

3. Italy: changes to the way licence fee collected

Italy’s PSM, RAI, which receives a high portion of its income from commercial sources, found the years after the financial crisis particularly difficult. 2009-2010 were the most challenging as advertising revenues declined although the licence fee remained the same.

RAI’s revenue has also been impacted by the number of viewers who avoid paying the licence fee. Until 2016 the licence fee evasion rates were particularly high in Italy, averaging 26% (in Campania it was more than 50%).

However, in 2015 Matteo Renzi’s government introduced an important reform: this linked the licence fee to household electricity bills, making the fee difficult to avoid.

As a result, RAI’s income increased by 12.5% in 2016, despite a decrease in the amount each household had to pay, according to the 2016 annual report.

4. Latvia: cuts and debts

Latvia’s public television broadcaster, Latvijas Televīzija, is mainly funded by a government grant (around 60%). The balance is made up from advertising revenue.

In late 2008 Latvia’s government cut funding to public radio by 25%. This, combined with a 35% drop in advertising revenue in the first six months of 2009, led to job cuts (including the axing of Latvian Radio’s in-house choir). In early 2009 the station announced accumulated losses of more than one million euro. Faced with bankruptcy, the organisation’s General Director resigned while Latvia’s government paid off the debt.

5. Poland: still vulnerable to political pressure

In Poland, less than a quarter of public television’s income comes from public funds, including the licence fee. Despite its relatively low dependence on the government for funding, the PSM (Telewizja Polska – TVP and Polskie Radio) remain vulnerable to political pressures. This is because, since 2016, the ruling Law and Justice Party has had the right to appoint three out of five members of TVP’s governing body.

This level of political influence has already had an impact upon PSM content. National themes are increasingly visible on public television, in line with government’s policies.

The last two TVP annual reports show increasing annual losses: nine million euros (36,6 million PLN) in 2015, 45 million euros (180 million PLN) in 2016.

6. Portugal: public funding halved

Following the 2008 financial crisis, Portugal’s government, was advised by Troika (the International Monetary Fund, European Central Bank and European Commission) on how to accomplish financial goals concerning deficit and public debt: one of the results was that public funding for RTP, the country’s PSM, was cut by half, from nearly 110 million euro in 2011, to 52 million euro in 2013. There were even discussions on the value of public service media in Portugal. RTP is now supported only by licence fees and advertising.

7. Romania: PSM rescued from bankruptcy

In Romania, the financial situation of the public broadcaster, TVR, began to deteriorate after 2005, following expensive acquisitions and poor management, to the point of insolvency in 2016.

Romanian public television had experienced financial difficulties for almost 10 years, under seven different directors. As a consequence two television channels, dedicated to news and culture, were cut.

Early this year the government eliminated the licence fee, and announced it was increasing the state budget for TVR and Romanian public radio, by approximately 7.5 times the amount it received in 2016. Critics claimed this move was aimed at making the PSM more dependent upon the state.

However, in the short-term, this increase will enable TVR to pay its considerable debts to the state budget.

8. Switzerland: cutbacks and pushback

The economic crisis did not have an immediate impact upon Swiss PSM – mainly because the licence fee provides most of its income and licence fee avoidance is not a significant problem. However, there have been some notable cutbacks since 2008, including a 2016 threat to withdraw funding from the Orchestra of Italian Switzerland, which received 25% of its eight million euros budget from the Swiss Radio and Television Corporation.

Political pressure has increased recently, following the launch of an increasingly popular initiative (No Billag Initiative) which lobbys to abolish licence fees.

9. United Kingdom: licence fee freeze and major cuts

Cuts to Britain’s public service media, the BBC, started in 2007 when then Director General, Mark Thompson, announced plans to reduce the size of the organisation. Over 2500 jobs were cut and programming output reduced.

In 2010, in response to the economic crisis, the government announced that licence fees would be frozen at £145.50 per household per year, for six years. David Cameron, then prime minister said the corporation must “live within their means”. The BBC was also told to take on extra financial commitments including funding the BBC World Service.

Further cuts were made in 2011 to reduce the total overall budget by 20%. These included moving BBC3 online only (also seen as a move to attract younger audiences) and selling BBC assests, including the BBC Television Centre.

Immense resources, huge responsibility

The EJO’s study of European PSMs reveals that post-2008 funding and revenue cuts have had a significant impact on PSMs whatever their size, although in very different ways.

The financial crisis also appeared to have been an opportunity for opponents, including commercial media organisations, to challenge the legitimacy of public service media all over Europe, no matter how well-financed or well-managed.

These challenges have included limiting PSM access to advertising income, challenging licence fees and even attacking the concept of publicly-funded broadcasting.

The second part of this study will discuss PSM independence across Europe and the study’s finding that funding methods appear to make little difference to the levels of independence from government.

This is the first part of a two part study, comparing Europe’s PSM. Part 2, on Europe’s public service media and independence, to follow

With Tina Bettels Schwabbauer, Ainars Dimants, Michał Kuś, Caroline Lees, Ana Pinto Martinho, Antonia Matei, Stephan Russ-Mohl, Massimo Scaglioni, Sandra Stefanikova, Adam Szynol

Pic credit: Dave, Flickr CC licence

- 165Shares

- Facebook117

- Twitter11

- LinkedIn14

- E-mail7

- Buffer14

- WhatsApp2

Tags: ARD, BBC, Czech Republic, Germany, Italy, Latvia, licence fee, media independence, PiS, Poland, PSB, PSM, public service broadcasting, public service media, Rai, Research, Switzerland, ZDF