How well are Europe’s Public Service broadcasters (PSBs) facing up to the challenges of digital news? And does the success of PSBs stop users paying for online news on other platforms?

These are just some of the many issues tackled in this year’s Reuters Institute Digital News Report (DNR), a survey of over 50,000 people across 26 countries and the world’s most authoritative report on digital news. The report highlights problems affecting news providers, including the combined impact of the rise of social platforms, an accelerating move to mobile devices, growing consumer rejection of online advertising and the rise of ad blocking.

Many of the issues raised – such as how to deal with video online and the rise of distributed content where news is consumed through third party platforms, rather than the news brand itself – pose dilemmas for all news providers, whether public service or commercially-funded.

Earlier this year the Reuters Institute published a report examining the strategic, political and public policy issues facing several European PSBs as they move online. A subsequent Reuters report looked at the challenges facing TV news over the coming years. The 2016 DNR provides an opportunity to apply the latest data to these issues. [1]

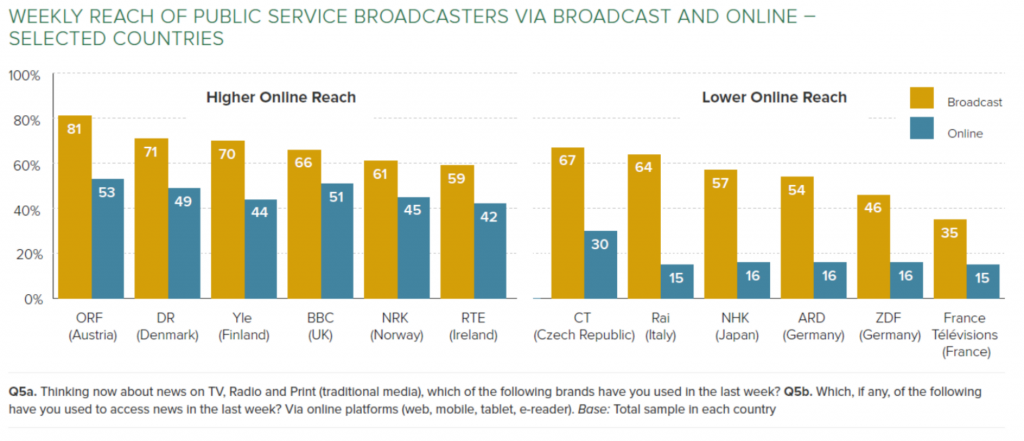

Polarised PSB performance online

In the UK part of the debate over the BBC reflects concerns that it is too successful online (hence recent government proposals to restrict the range of content on the BBC website). However, Europe’s other PSBs polarise between a few that do well online and the majority which struggle to attract online audiences that come close to matching their broadcast performance.

In France, Germany and Italy, PSB TV broadcasters reach around 15% with their online news output, compared to around half via TV. By contrast, PSBs in the Nordic countries, Ireland and the UK are among the most used news brands, both online and offline. Thus, in Austria, ORF news reaches 81% via TV and radio, and 53% online each week, with figures of 71% and 49% in Denmark, 70% and 44% in Finland and 66% and 51% for the BBC in the UK. There is no one single factor that might explain these differences although regulatory restrictions are important in some countries. But it is striking that integrated PSBs, covering Radio, TV and Online in a single organisation, (as is the case with the high performing broadcasters) seem to have found it easier to develop a successful digital strategy and breakthrough in the more competitive environment online, than PSBs that have traditionally just been active in one area, such as TV – as is the case with the French, Italian and German PSBs cited here.

Reaching Younger Audiences Online

Reaching Younger Audiences Online

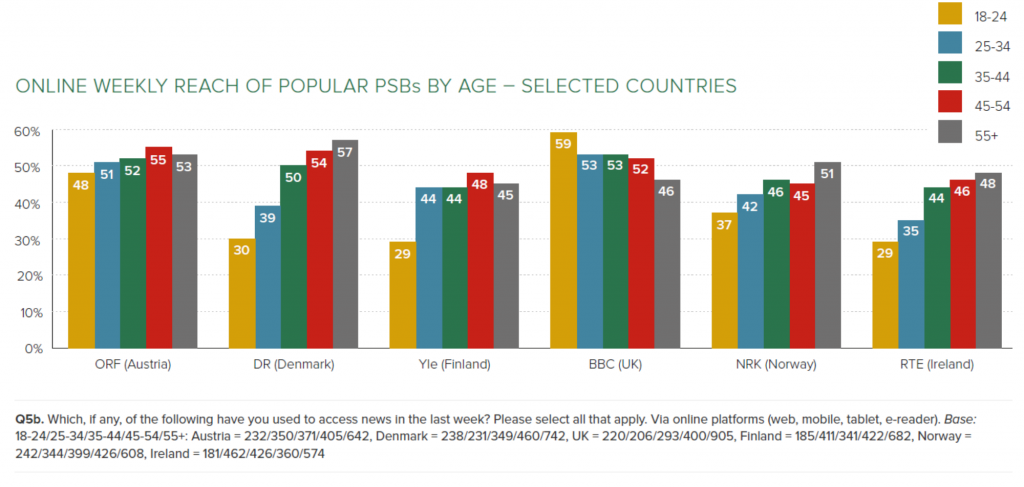

There is a further complication for PSBs aiming not just to reach large numbers of people, but as more and more people access news online, to also ensure that they fulfil their mandate to serve all groups within society. Reuters Institute research has previously highlighted the fact that some PSBs are finding it difficult to reach younger audiences who are less interested in TV news. But in our 2016 report we focus specifically on online reach and break it down by age. This analysis shows that even amongst those PSBs with a large online reach, audiences in Nordic countries and Ireland are slightly skewed towards older users whereas ORF in Austria and the BBC in the UK appeal to different age groups more evenly, with the BBC online particularly popular with 18-24s.

Impact of PSB use on Paying for News

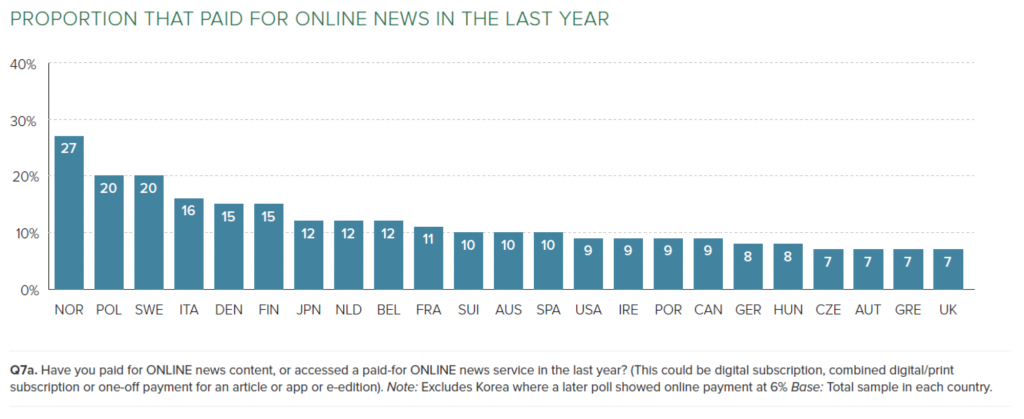

Across the 26 countries the proportion of those surveyed who are paying for news online (whether in the form of digital subscription, combined digital/print offer, or one-off payment for an article or e-edition) is relatively low, ranging from just 7% in the UK, to 27% in Norway.

However, simply looking at the raw percentage of people that have paid for online news only tells part of the story. Arguably more important for publishers is how much people are actually paying. There the UK is actually at the top of the list with an annual reported median payment of £82 from the 7% who say they pay for online news. Countries where subscription payments dominate online – as in the UK, US, Australia and the Nordic countries – tend to report a higher level of media payments.

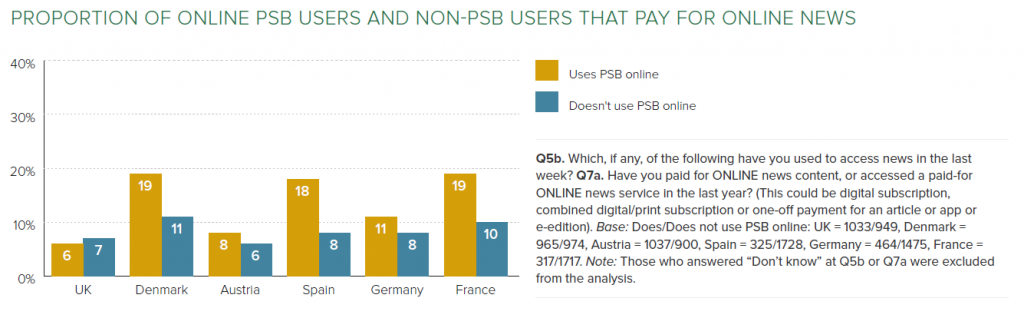

Although the presence of well-funded PSBs with a large reach is often blamed for the lack of enthusiasm to pay for online news our international research has found no evidence that online PSB news consumption has a negative effect on paying – even after controlling for numerous other factors (including age, gender, income, trust in news, and interest in news).

Clearly there are complicated issues at play here and our report looks at trends across multiple countries rather than examining the detailed picture in any one country. But in the countries with high online PSB reach (UK, Denmark and Austria) use of PSB services seems to have no negative impact on people’s readiness to pay for news online. A similar pattern is repeated in the countries with much lower PSB online reach. (Spain, Germany and France).

No-one would deny that getting people to pay for news online is challenging. But the international data we have gathered this year suggests no direct correlation between PSB use and a reluctance to pay for news online.

[1] For information on the survey methods, sample size etc, please see www.digitalnewsreport.org

Pic credit: Flickr Creative Commons Charis Tsevis

Tags: digital news, digital news report, Online News, Research, Reuters Institute Digital News Report, Reuters Institute for the Study of Journalism, survey